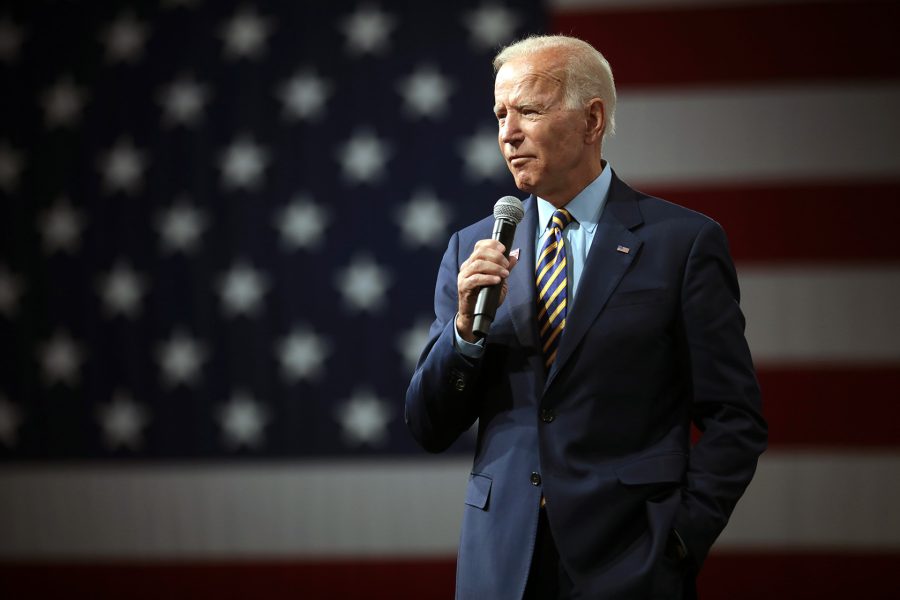

President Joe Biden created a student loan forgiveness plan for all college students that have student loans. I think this sounds like a great idea, but what does it really mean for us? Who will be paying for all of the student loan debt that is getting diminished?

Student loan forgiveness sounds nice but I know the money will have to come from somewhere within the United States. President Biden is in full force for writing off $10,000 in student loan debt for every college student. According to Ryan Lane this could wipe out debt completely for nearly 15 million borrows.

According to Steve Rossman, a certified public accountant, writing on a CNBC webpage, “If the government takes the next step and cancels some or all student loans, then the loan forgiveness, in many cases, will be taxable. Generally, when a debt is forgiven student loans or otherwise, the amount forgiven represents taxable income in the year it is written off.”

This means that as a borrower, if your student loans are cancelled out, then $10,000 will be added to your taxable income. In my opinion, having that money added to my income will hurt me more than it will help me in the end. I will have to pay into the government because of this when tax season comes around.

From the beginning of his campaign, President Biden has been very proactive about helping college students with student loan debt and many other problems that come with being a college student. I think that President Biden’s heart is in the right place trying to help Americans get college educations without going into debt because of it. While it is a nice gesture, student loans are a part of being in college.

I am a full-time college student working full-time in order to make it through college. While it definitely isn’t fun sometimes, it is a sacrifice that you have to make in order to get through college. In the end having a college education is rewarding for those who graduate. I would rather have to pay back my student loans on my own, than have to pay taxes on a forgiveness plan.