By: ELLIOT GONNELLA

Internet sales tax is new revenue, unlikely to save physical locations

Online shopping has been a talking point in regards to both politics and economics for almost the past two decades. Cyber Monday, the unofficial online-shopping holiday on the first Monday after Thanksgiving, is approaching its fourteenth year of existence, it has now surpassed Black Friday with total sales in a single day.

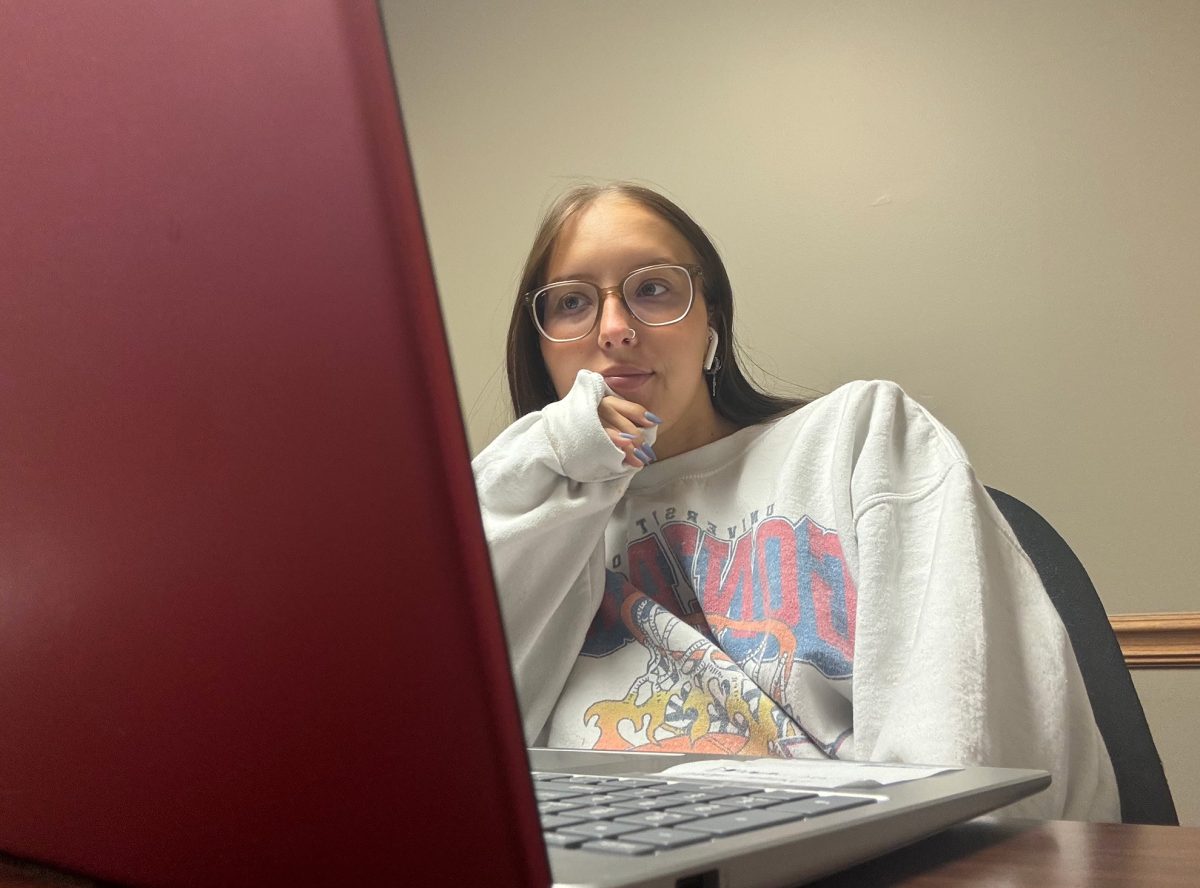

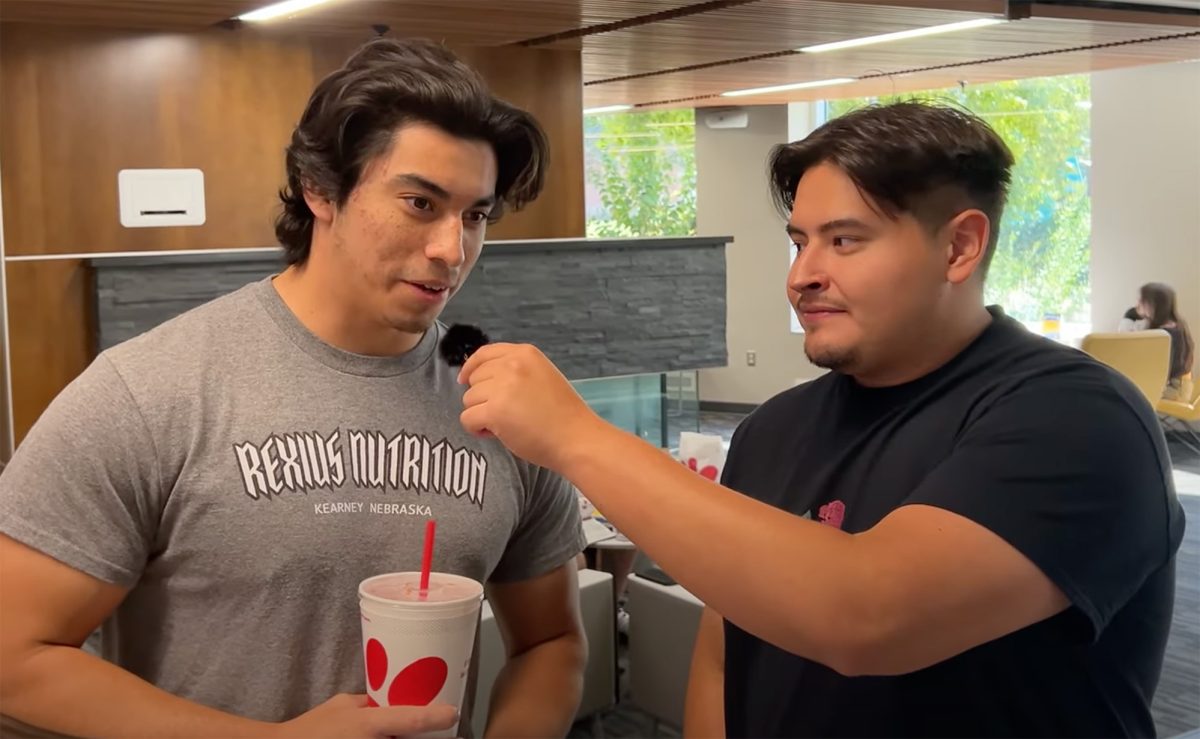

With the rise of online companies like Amazon, which accumulated of over 73 billion dollars in the last quarter of 2018, there has never been a better time to shop a wide variety of items that may not be found in your traditional brick and mortar stores. University students especially benefit from the ease of buying things at a discounted price and finding specialty items that other places wouldn’t have at a local corner on the market.

As with any advancement, there have always been detractors with complaints that can be logical, emotional, irrational, or some combination thereof. Perhaps the one that has held the most weight is not that the online economy is destroying physical locations, at least not at the rate commonly said, but the issue of taxation.

Taxing online sales has always been something akin to an accountant’s Wild West, full of contradicting rules, varying levels of qualification, and the voluntary mention of sales for both businesses and the consumers. I am not that surprised that governments have been looking for a way to tap into that revenue stream for their own benefit, and after years of trying, the states got their opening.

Taxing online sales has always been something akin to an accountant’s Wild West…..

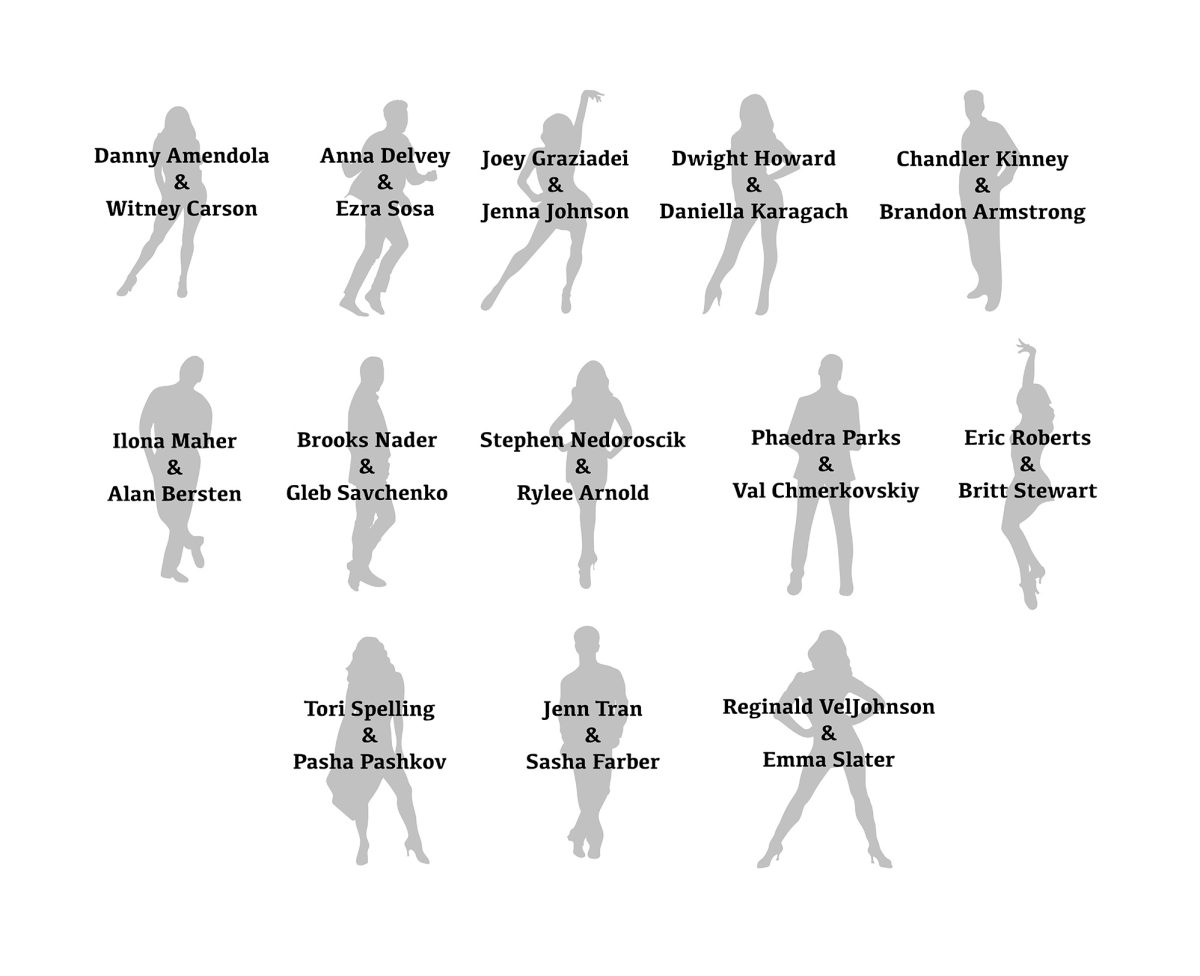

In the recent court ruling, South Dakota v Wayfair Inc., the Supreme Court decided to allow states to enforce sales taxes on companies that use the internet to sell products. Almost twenty states, including Nebraska, have started to create legislation to be introduced, pending the ruling of the court to get that sought after revenue from businesses, large and small.

I have already seen taxes collect revenue from some purchases online I made through Amazon, and at the moment they are reasonable. They’ve proven to be nothing extravagant, just a few more bucks after I confirm my address. So far, these taxes do not concern me when it comes to paying them.

What does concern me is how these taxes will be administered throughout the states.

The Court only gave the green light for states to collect taxes; it did not lay out a specific plan of how these taxes would be collected, what rate would be acceptable, and what exceptions would be given. So while permission has been granted for revenue to be collected, it is still going to be the preverbal Wild West for the state revenue agents and those who handle the accounts for businesses.

Each state is going to have their own rules, and it will still be a jumbled mess of limits, rates, and taxable sales. Nebraska, for example, is looking at enforcing taxes on online sales for those that make more than $100,000 in sales or two hundred transactions online. Other states have proposed stricter tax rules, or similar but slightly different exceptions.

While smaller companies may not need to worry too much about these rulings, it will be difficult to keep up to date for medium size and up companies that don’t have the resources of a corporation.

The way the states plan to spend this sudden flush of income is also a bit disheartening for me. Governor

Ricketts is pushing for the revenue from online sales to be used to fund property tax relief, in a time where public education and other services are seeing a decrease in their budgets. Nothing has been set in stone yet, but it seems that the executive and some legislatures of our state aim to use the sales taxes as a pork barrel for a select few of their voter base.

Finally, I do not see these taxes as a way to ‘save’ the mom and pop stores from the big bad online retailer. The landscape of the marketplace is changing and technology will always be an asset for any company, both to keep up with the rules and regulations in addition to being open to a wider consumer base. Businesses will not come back to Main Street because of these taxes.

You may see a slight cost increase in ordering products online in the future, but very little else will change as a result. The government is taking their share, and one can only hope the funds are appropriate and serve a real purpose and not as a slush fund for supporters.